- Research

- 15-nov-2024

UK operational real estate investment sees strong comeback - research

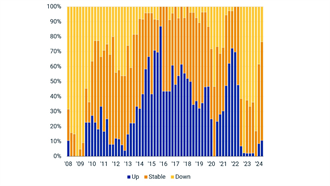

A new study from CBRE reveals that operational real estate in the UK has experienced a significant rebound in 2024, with investment activity expected to continue its upward trajectory in 2025.

Read more