- Finance Watch

- 05-Jul-2024

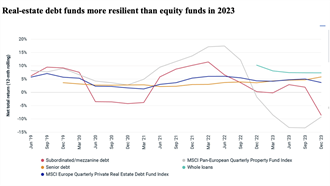

MSCI launches first tracker for European property debt funds

Indices provider MSCI has launched the first index tracking European real estate debt funds.

Read moreIndices provider MSCI has launched the first index tracking European real estate debt funds.

Read more

The subsector's high occupancy and rebased rents attracted three more investors looking for higher yield assets, income spread and rental growth.

Read more

Shareholders, savvy CEOs and conviction that the market has hit bottom are driving a bout of merger fever in listed property companies. Jane Roberts spoke to some of the players at the centre of the action.

Read more

In a busy week, Blackstone, Landsec and Segro were buying and Goldman Sachs, Macquarie and Meadow Partners closed new funds.

Read more

Sellers are bringing London offices, European hotels and UK student housing to the market this week.

Read more

A €600 mln student housing portfolio and a stake in a regional shopping centre are put up for sale by Gecina and Nuveen Real Estate.

Read more

Two large Swedish transactions agreed this week are further evidence of recovery, as the Nordic market continues to pick up.

Read more

Shares in Tritax Eurobox shot up after Brookfield Asset Management confirmed its interest in bidding for the pan-European logistics REIT.

Read more

Nuveen, Heitman and Catella cite the favourable structural dynamics and recent price adjustments as attractions in the Nordic living sector.

Read more

Sovereign wealth funds were involved in sales of two giant malls, and investors snapped up UK hotels, a life science project and West End shops.

Read more

Swiss real estate group Investis has boosted its real estate holdings with the CHF 139 mln (€149 mln) purchase of prime residential properties in Vaud canton.