Elections, what elections? International and domestic real estate investors are focusing on the fundamentals in Italy, and seem totally unperturbed by the general election vote this Sunday, panelists agreed at the PropertyEU's latest briefing on the market.

‘There is concern about the upcoming elections, but it is not strong enough to change the positive outlook investors have about the country,’ said Alexandre Fernandes, head of asset management Europe at Sonae Sierra. The potential for political instability is recognised but does not loom large in investors’ minds. At the forefront are the economic recovery after many years of recession and the many opportunities the market offers.

Record volumes

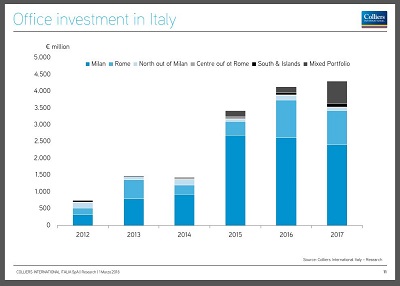

‘After three consecutive years of record investments in Italian real estate, in 2018 Italy remains in the top tier of preferred investment destinations,’ Simone Roberti, head of research at Colliers International Italy, told PropertyEU's Outlook 2018: Europe & Italy Investment Briefing. The event was held on 1 March at Dentons’ offices in central Milan.

Investment volumes last year reached €11.3 bn, nearly twice the ten-year average, and 2018 has started on a positive note as the market continues to be dominated by foreign capital. ‘Investors, who come mainly from the US, France and the UK, tend to focus on the favourite trio of offices, retail and logistics,’ Roberti said, but there is a growing interest in alternatives from hotels to care homes to student housing.

‘It has been interesting to see the shift in international investors’ mood,’ said Gabriele Pompei, managing partner, PURE Investment Management. ‘They used to be concerned with the weaknesses like the stagnant economy, bank debt and political instability, but these macro concerns have gone. Now investors want to deploy capital and their only focus is on specific real estate issues.’

______________________________

Click here for video highlights

and the presentation from the event

______________________________

Core assets

The main issue is intense competition among investors for core assets which are increasingly hard to find. ‘The most important challenge is how to deploy capital,’ said Fernandes. ‘In 2018 there is a real tension between the pressure to invest and the feeling that some assets are overpriced, but we still see very good opportunities in Italy if you move up the risk curve and into the secondary market.’

Everyone wants to buy a prime shopping centre in Italy, he added, opting for dominant, good quality assets in a secondary city provides a good cash yield as well as capital appreciation. ‘I am convinced 2018 will be a very good year for retail,’ Fernandes said.

While Milan remains by far the strongest market for offices, followed at a distance by Rome, there are signs that investors are widening their horizons when it comes to other asset classes like retail and hotels.

Hospitality was one of the success stories of 2017, with investments doubling to nearly E1.4 bn on the back of a steady increase in the numbers of foreign tourists as well as more ‘staycations’ by Italians spending their holidays in the country.

New money

‘International investors are looking beyond the usual four destination cities of Milan, Rome, Venice and Florence and they are now targeting cities like Bologna as well as resort destinations for the first time,’ said Marco Comensoli, head of hotels & leisure, Colliers International Italy. It is still seen as a riskier investment than offices and it requires ‘a braver kind of investor’, but there is no shortage of them.

‘New investors are coming in who had never deployed money in Italy before and more brands are coming to the market, including lifestyle brands, so there is a really positive momentum to the market,’ Comensoli said. ‘It is going to be another positive year for the hotel sector in Italy.’

Close call

Italy's upcoming elections are largely described as 'too close to call' in the Italian media, as while the anti-establishment Five Star Movement (M5S) is likely to get the most votes, Berlusconi's right wing electoral alliance is seen as the only group with a chance of winning an outright majority.

While Berlusconi cannot stand for office after being convicted for tax fraud, and his conservative Forza Italia party has fallen to a 15% opinion poll rating, his deal with the right-wing populist Northern League led by Matteo Salvini places a potential right-wing coalition in lead position, polling at around 37%.

Berlusconi is playing a largely figurehead role in these elections, but has attracted a suprising amount of youth support on a low tax and anti-immigration ticket.

The Italian left, ranging from former prime minister Renzi's Democratic Party (PD) to a variety of radical left groupings under the umbrella of Liberi e Uguali (Free and Equal), are largely divided with the PD in particular having lost popularity. The last opinion poll put the PD on 22.7% and Free and Equal on 5.4%.

All the major parties are promising tax reform, with Berlusconi's alliance proposing a €12,000 personal allowance plus a flat 23% tax on remaining income for all. At the moment there is no personal allowance for tax payers in Italy. The proposals are spooking the markets, as Renzi argues they would worsen the country's budget deficit and cost the country around €95 bn.

Berlusconi's party is also strongly anti-immigration, with Berlusconi recently describing the migrant situation as 'a social bomb ready to explode'.