Spreads on public real estate debt have increased rapidly in response to the coronavirus crisis, says CBRE.

Paul Coates, head of EMEA debt & structured finance at the firm, said that investment grade real estate corporate bonds had seen yields to maturity increase by over 100 basis points by the end of March 2020 compared with a month earlier.

Meanwhile, in structured finance, the CMBS and syndication markets are ‘effectively closed.’

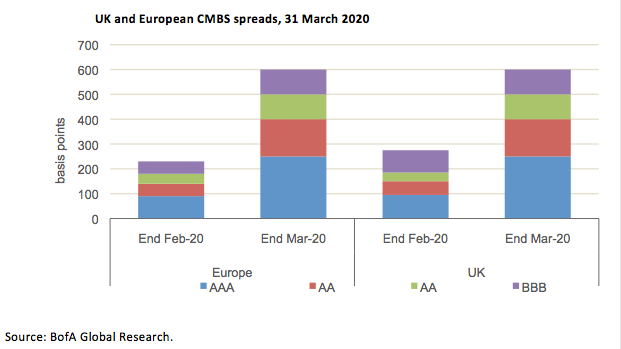

He said that where spreads are quoted, BofA Global Research report UK and European AA CMBS spreads as having risen to 400 bps over the month, from 140 bps and 150 bps respectively at the end of February.

‘We have seen a near halting of the CMBS and syndication markets, which can effectively be considered closed for new issuance’, Coates said.

‘This has a significant impact in itself to participants in this market, but also affects things further up the pipeline as lenders reliant on this exit route may not start to begin originating again until they are confident that it will open back up.’

However, Coates added that it ‘felt unlikely’ that the levels or extent of losses seen after the global financial crisis will be repeated. The CMBS ‘2.0’ market - new deals issued after the GFC - have generally been better structured with more sensible leverage and fewer loans.

The CMBS market has also remained small and has not recovered to pre-GFC crisis levels.

He also said that it was ‘arguably’ the public debt markets where investors first saw value after the GFC and where capital returned first.

‘While it will likely take time for new CMBS and syndication deals to come to the market, it may well be that pricing stability and recovery in new and existing REIT debt and existing packaged loan structures will again give investors the first signs of an upturn in fortunes in the wider real estate market.’