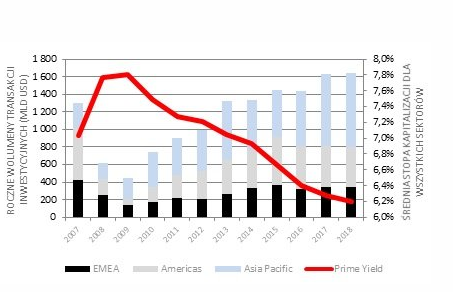

Asian investors are likely to continue to dominate the global real estate investment market as the range of capital sources within the region increases, Cushman & Wakefield predicts in its Global Investment Atlas 2018 presented at Mipim on Wednesday.

Investors from Asia were the major driving force behind record levels of real estate investment in 2017, with money from the region accounting for more than half of all capital deployed and 46% of all cross-border activity, the firm's researchers found.

Global investors from the APAC region increased their exposure to most markets, with the US a notable exception as a range of factors including the stage of the market cycle, uncertainty over US policies and domestic capital controls in China, all combined to deliver a fall in activity.

Investment from Asian sources grew by 96% year-on-year, primarily as a result of several very large-scale transactions, including platform acquisitions marking steps towards the implementation of China’s Belt and Road Initiative.

Contrary to the widespread view that European and American populism would result in a less adventurous investment community and a strengthening of domestic purchasing, local buying in both Europe and North America decreased on the year with the global increase in domestic investment driven exclusively by home buyers in Asia Pacific (+39.9% year-on-year).

US lead narrows

The US remains the main target for international investors but its lead has narrowed and regionally, Europe was strongly ahead, attracting 50% of all cross-border spending.

At a city level, London persisted as the most sought-after destination for international capital as concerns over Brexit were diffused by faith in the city’s long-term appeal as well as a decline in sterling, C&W found.

Carlo Barel di Sant’Albano, CEO of Cushman & Wakefield’s global capital markets and investor services business, said: ‘Global real estate performed exceptionally well in 2017 with volumes up sharply and increasing valuations. This has provided good momentum going into 2018 and the balance of pricing, supply and demand all point to a further healthy year. Indeed, while stock is hard to find, we are forecasting a small gain in global volumes thanks to more development, an increase in profit taking and more corporate activity.’

Europe bursting with health

On a regional level, Europe is widely acknowledged to have experienced its healthiest economic performance in a decade in 2017, C&W said. The UK and Germany remained the most targeted markets in the region as overall volumes in the UK closed the year +3.9% above those in Germany, where a shortage of stock has frustrated the long queue of buyers looking to invest.

Report author David Hutchings, Cushman & Wakefield’s head of EMEA investment, commented: ‘Perhaps the strongest reason for cheer at present is the health of the economy and the globally synchronised nature of the upturn we are seeing. The increase in real estate development and forward funding in 2017 shows that investors already recognise this but the strength of the occupier market may yet surprise in the year ahead.’

He added: ‘Trade wars could knock us off course but as solid economic momentum and tighter labour markets encourage more business investment, the cycle is still likely to be extended. It could be boosted further by the successful adoption of new technology and ways of working. At the same time, we are likely to be at the start of a rising trend in inflation, but the pace of interest rate tightening should remain slow and policy will be stimulative for much of 2018.’