With occupiers concerned with everything from technological upgrades to autonomous vehicles and environmental specs, are today’s warehouses primed for longevity or risking obsolescence?

Affectionately dubbed ‘big boxes’ and ‘sheds’, there is a long-held perception that the defining trait of warehouses is their simplicity. With landlords largely providing four walls, and significant fit-out capex falling inevitably on occupier shoulders, it would be easy to think that building innovation isn’t a major investor issue. However, the rapidity of the tech revolution means that this is no longer true.

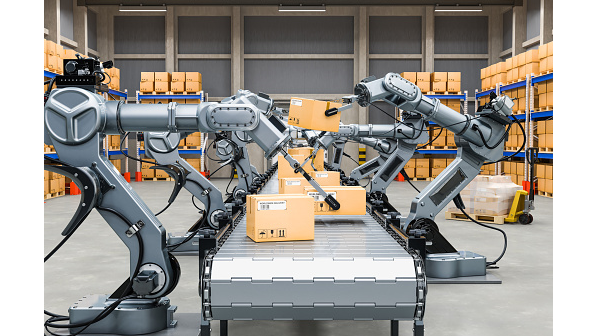

‘They have become more and more sophisticated. The warehouses of the future will be zero carbon and fully automated,’ suggests Ian Worboys, managing director of Trammell Crow Company (TCC) and head of European logistics. ‘They will probably be power generators. We have a team focusing on what the warehouses of the future look like, as you have to be ready for anything. What happens if local authorities suddenly decide that all lorries need to be electric from tomorrow, so every parking space suddenly needs a power plug? Inside warehouses, robots and machinery have ever increasing power needs. So, the near future may demand photovoltaic panels on roofs, combined with batteries that charge overnight.’

Worboys also identifies increasing sophistication in office spaces on industrial sites. ‘When I started in this business in the 1980s, warehouse offices were basically portacabins. Now, the offices attached to every warehouse are as fully functioning as offices in the centre of cities. You need to attract the best people, which requires sophisticated spaces; state-of-the-art stock systems need onsite IT teams and all the rest,’ he says.

Environmental standards

Stephan Riechers, head of industrial at Union Investment, says that such concerns are a big part of why they focus on purchasing new builds. ‘When we acquire brand new assets, it’s much easier to fulfil environmental, social and governance (ESG) requirements. It’s also part of our strategy for avoiding the competition: building ESG-compliant portfolios is much more expensive; but we have extensive development experience and are a very reliable counterpart for our development partners. A significant transfer of knowledge takes place,’ he notes.

For Alistair Calvert, CEO Clarion Partners Europe, the logistics development business is still moving fairly slowly when it comes to construction innovation. ‘One thing we are doing is building more and more sustainably; the bigger shift is building to better specs,’ he notes.

‘There is more demand for aspects such as super-flat floors for forklifts. By focusing on quality, we think that our buildings will be just as relevant if trends such as autonomous vehicles take hold.’

He adds: ‘We are also seeing geographical differences emerge: for example, standards for insulation are different in Germany compared to Spain. But we think that landlords will be increasingly rewarded for ticking ESG boxes and that BREEAM Outstanding or the equivalent will eventually become the standard.’

The role of proptech

Riechers agrees that warehouses are relatively simple to build and that tenant spend on fit-out is often higher than the value of the building. But he affirms that landlords need to be abreast of occupier tech to provide better spaces. ‘Tenants which are willing to invest a lot of money in the right properties, won’t move on so quickly,’ he notes. ‘We also seek to be proptech literate in the logistics space and test out exciting use cases to see if collaborations make sense.’

Union Investment has to date backed proptech startups ranging from data rooms specialist Architrave to construction tech PlanRadar, and Riechers says that the firm finds flexe.com very interesting as a pioneer in the nascent flexible warehouse movement. Flexe.com allows landlords to offer ‘on demand’ temporary spaces across their warehouse portfolios, with software similar to the technology driving the flexible office market.

For Logan Smith, head of logistics & industrial, Europe for Hines, logistics landlords who want to be proptech savvy should probably look at the issue from a different angle. ‘As with every property sector, sustainability and proptech will become more important for logistics assets too. But industrial is fundamentally different - because the relevance of the assets and locations themselves results from global supply chains, trade flows and the technologies that underpin them.

‘As supply chains move and shift, so will the types of logistics assets that are needed. This was the case twenty years ago, as enterprise resource planning (ERP) led to the first wave of warehouse development for regional consolidation. And more recently as well – whether we admit it to ourselves or not, many of us who are experienced operators and developers in this sector have frankly been surprised by the strength of demand for logistics space generated by higher e-commerce absorption globally.’

From Covid-19 to e-commerce, tech makes its mark

The pandemic altered forever the way that the real estate industry views digital tools. Combining that with tech-savvy tenants in logistics makes for a potent accelerator, says Zain Jaffer, real estate and proptech venture capitalist and partner at Blue Field Capital. ‘Proptech has been a major force in helping the logistics and industrial sector transform and perform through Covid-19,’ he suggests.

‘Already, robots have made fully automated processing possible; distribution centres can leverage smart technologies to predict and analyse consumer patterns, helping them better understand and secure their supply needs. AI management systems are facilitating a better system for the receipt and dispatch of a greater supply volume, resulting in quicker loading times and more efficient delivery systems from end to end.

‘And there’s been no shortage of imaginative applications for drones and robotics when it comes to delivery. Consumers are looking forward to a future in which they can see tiny drones flying their groceries to their door step, and while we might not be there yet, we’re also not far off. CargoPod is an autonomous vehicle that delivers groceries in residential areas, and it would be a losing bet to think it will be the only one of its kind.

He adds: ‘The future of proptech in the industrial sector is exciting. So far, automating more warehouse processes has kept workers safe throughout the Covid-19 pandemic. Soon, the powers of smart technology could take distribution centres to new heights and/or new depths – some experts are predicting that a shortage of land will cause warehouses to be build underwater and in the sky. It’s impossible to know how far these advancements could take the logistics sector, but it seems safe to say the future of the industry will be significantly different than that we can imagine today.’