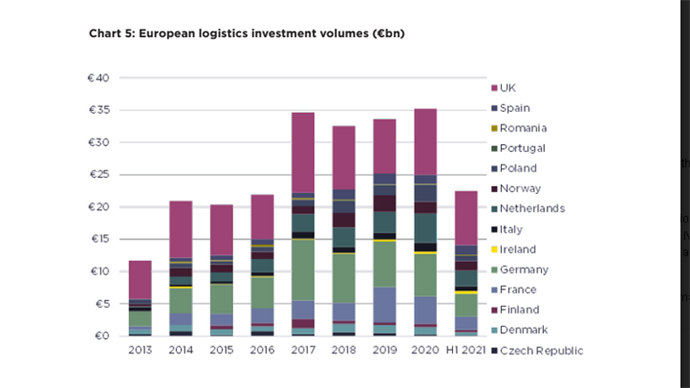

The European logistics market is on track for another record year, as investment volumes and take-up activity are already in excess of five-year averages at the half-year point.

European logistics set for another record year, says Savills

- In Research

- 09:42, 08 September 2021

Premium subscriber content – please log in to read more or take a free trial.

Events

Latest news

Best read stories

-

Firethorn Trust launches third-party management services

- 22-Jul-2024

Real estate investor, developer and asset manager, Firethorn Trust has appointed Charlie Ingham as director of Firethorn Investment Management, its third-party investment, development and asset management services offering.

-

-

-

- 23-Jul-2024

Stoneweg and Bain Capital divest Barcelona hotel

-