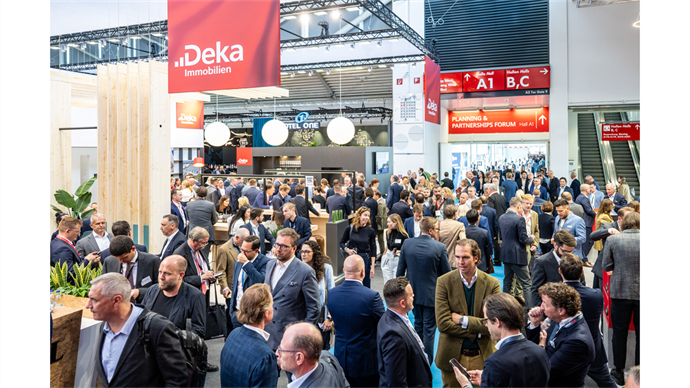

The mood at Expo Real this year can best be described as cautiously optimistic, with many delegates reporting that opportunities are starting to emerge.

After a difficult period in which rising interest rates scuppered many real estate companies’ strategies, the feeling in Munich is very much that opportunities are starting to unfold for those investors with the requisite skills and appetite for risk.

Marco Kramer, global head of research and investment strategy at Real IS, for instance, told PropertyEU that prime retail assets in major urban locations had at last bottomed out and represented good value. ‘If you have a higher risk appetite, you should do shopping centres,’ he said.

‘In my view, it is perfect timing as the worst is behind us. Footfall in the major cities in Germany is coming back. Wages need to recover, but in general I would say in terms of rents the story is you need to invest in shopping centres.’

For others, the picture is more nuanced. According to Michael Siefert, managing director and head of Madison’s European business platform, investors need to be far more selective than they used to be. ‘When we first started conducting this business 20 years ago, we were asset class agnostic,’ he said.

‘Today the whole market has shifted. Investors are much less agnostic about where their capital goes – investors have strong views on offices and retail. Conversely, there are some newer segments like data centres and cold storage with strong operating fundamentals that are establishing themselves going forward.’

Part of the issue is pricing: in some territories and segments, it is likely that values have stabilised; in others there may still be a way to go. Alex Lukesch, managing director and head of European investments at Madison, commented: ‘London was an early mover in terms of repricing even vis-à-vis the US. Europe tends to lag both the US and the UK.

‘Valuers were more realistic early on in London, while in Paris and Frankfurt owners are slower to face the music. That’s probably no different now. But while the bid-ask spread in London has reduced, it’s still there.’ Despite this, Lukesch feels that the market shouldn’t take too long to get back up to speed. ‘I predict a return to relative normality in the second half of 2025,’ he said.

Marcus Cieleback, chief urban economist at Patrizia, agreed, adding that it isn’t yet clear how some of the structural issues facing the industry will pan out. ‘The mood [at Expo] is better than I expected, but possibly due to the weather,’ he said. ‘I think there is some optimism, but there is still a lot of caution about how all these structural changes we have seen over the past three to five years will shape the industry going forward.’

He elaborated: ‘We had these changes in the retail sector and we are now seeing green leaves emerging in many retail segments. Then there are the structural changes in the office sector. We are still dealing with working from home, mobile working. It will not make the office obsolete. It will change the office. So I think people are trying to understand how all these structural changes that are happening in parallel in different sectors impact their portfolios and how they should position themselves going forward.’

And that, Cieleback added, may take time. ‘I think we will have definitely more clarity in one or two years’ time,’ he said, predicting that pricing should stabilise over a similar period. ‘Buyer and seller expectations are coming closer together. I think the improving mood and declining interest rates help to align buyers and sellers a little more. If liquidity or transaction activity returns, more clarity will emerge on what is tradable.’

Indeed, while the mood at Expo this year is markedly less gloomy than in 2023, the consensus is that it will take until next year or even 2026 for transaction volumes to truly pick up. ‘Our house view is that we had hoped to see a bit more progress by this point,’ said Charles Balch, head of real estate finance at senior lender pbb.

‘But interest rates have now started to move in most markets and I think we'll start to see a bit of a pick-up. I think we'll start to see some investment picking up, certainly next year. I would go with cautious optimism.’