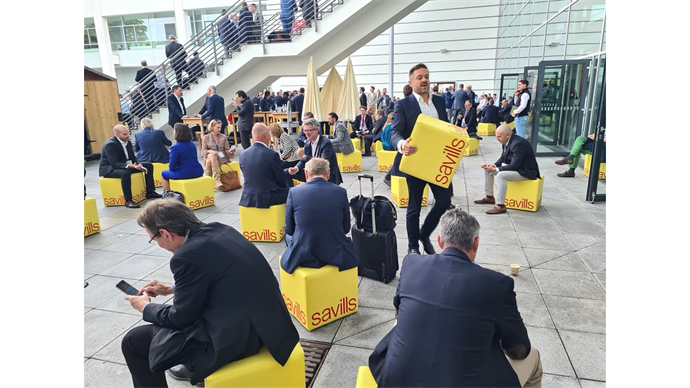

This year’s show is a curious mix of exuberance at meeting once again - after three years for most delegates - and a frisson of fear about what 2023 will bring.

‘We knew a black swan was coming,’ quipped a German investor at this year’s Expo Real. ‘We just didn’t realise he was going to bring all his buddies.’

In the face of rising inflation, soaring interest rates, ongoing labour market and supply chain pressures, banking stress and a continuing war in Europe, Expo Real delegates could be forgiven for focusing on the negatives. But in the gutsy property sector, players are always looking for the upsides.

Of course, there are also plenty of downsides – from the sublime to the ridiculous. ‘We invested in a very expensive new stand for this year’s Expo Real,’ confessed one institutional investor. ‘We signed the contract last November. I don’t know if we would have done that if we’d known what was coming.’

This year’s Expo Real has to date been a tantalising mix of exuberance at meeting once again – after three years for the majority of delegates – and a frisson of fear about 2023, which many are predicting will be an annus horribilis. As delegates enter the fair on Thursday morning, several of the conversations they have will confirm that recession is around the corner and not all firms will survive. And yet, for many of real estate’s most experienced players, it’s not all bad news.

‘Real estate was in a pretty good place before the current crisis,’ Rainer Suter, head of core fund management real assets at AXA Investment Managers, told PropertyEU. ‘The economy was pretty sound with low unemployment and a general workforce with a high level of education. Markets were also stable. In general, firms have much lower LTVs than they did 20 years ago.

‘Real estate has been affected by external factors – increasing energy costs, supply chain and production issues – but the real estate industry itself is much more advanced and technically proficient than ever before. Things like quarterly valuations are a marker of the health of the market.’ He added: ‘We’ve learned from the past. Communication, trust and past performance are also key in keeping investors on side and preventing runs on open-ended funds. We want to flank our clients in the long term so we do everything we can to keep them onside, no matter the market ups and downs.’

The current environment also has room for a few outperformers. Logistics real estate is still perceived as one of the industry’s most robust asset classes - if not the safest harbour for capital at the moment. Commerz Real CEO Henning Koch confirmed that his firm is angling for an opportunity to break into the asset class in the light of shifting prices which are likely to finally make it more ‘affordable’.

A number of last mile specialists – from Blackstone’s Mileway to newcomer Blackbrook – confirmed they remained positive about their niche, and particularly its robust occupier metrics. Meanwhile other logistics players told PropertyEU at Expo Real that they were keenly watching the progress of two fresh portfolios that had just come to market, in a sign that deals are not dead.

Added Frank Pörschke, CEO of P3 Logistic Parks: ‘The macroeconomic climate has changed significantly and we have to face that. Nevertheless, today’s situation is much better than the Global Financial Crisis. Look at the banking environment – they are better positioned than they used to be and capital ratios are higher. Regulation has contributed to their robustness. I don’t want to tempt fate but we don’t see the banks driving the crisis this time round.’

He added: ‘It’s true that headwinds have translated into more expensive debt and higher equity ratios for investors. This is also affecting logistics. But on the occupier side, logistics is still outperforming. At P3, we are currently enjoying 98% occupancy across the portfolio and we continue to see rental growth. Will this continue forever? I don’t know – but right now the outlook is good.’

Other bright spots are evident in certain geographies within diverse Europe. Take parts of northern Europe, for example. Said Jenny Tuleby, CBRE Investment Management’s new head of investment operations for the Nordics: ‘The region is definitely still a safe haven for capital following its resilient performance during Covid,’ she said. ‘We are more protected in the face of rising energy prices – not just because of oil but also because it’s a very green grid – we’re quite advanced in terms of renewables.’

Although the availability and cost of finance remain a hurdle, Tuleby believes that transactions will still happen – as long as vendors are realistic about pricing movements. ‘Both sides are starting to meet in the middle,’ she noted.

Yet other investment specialists remain convinced that darker days are round the corner - with distress increasingly likely. New research from Colliers has predicted that capital values could fall by 30% worldwide and Rory Buck, head of investments at Clarion Partners Europe, told PropertyEU that he had reached a similar calculation.

‘With yields moving by as much as 300 bps, rising LTVs raise the risk of default,’ he said. ‘We think distress is inevitable.’