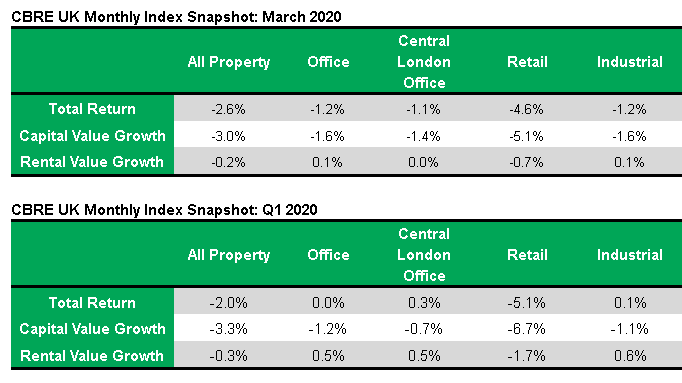

Capital values fell by -3.0% across all UK Commercial property in March 2020, according to the latest CBRE Monthly Index. This was almost entirely driven by a 14bps rise in yields, as rental values decreased just -0.2%. Total returns were -2.6%.

Over Q1 2020, capital values fell by -3.3%, while rental values decreased -0.3%. All property total returns were -2.0% for the quarter.

While no sector was immune, there was significant sector differentiation in overall figures and in underlying rental and yield trends. A 22bps increase in retail yields was more than double that seen in offices (8bps) and industrials (9bps), reflecting the greater immediate susceptibility of the retail sector income to the fallout of Covid-19.

The retail sector suffered a -5.1% decrease in capital values over the month. Within the sector there was further divergence, with the largest decreases reported for shopping centres at -6.7%, whereas high street shops South East fell by only -3.3%. While the office and industrial sectors did not experience falling rental values, retail rental values declined -0.7%, further illustrating the vulnerability of retail income in the face of Covid-19. Rental values were worst hit for high street shops rest of UK at -1.2%. Total returns for the sector overall were -4.6%, pulled down by shopping centres at -6.1%.

The office sector recorded negative capital value growth of -1.6% in March. Rental value growth remained positive at 0.1% and total returns were -1.2%. This is the first month since August 2016, in the wake of the Brexit vote, that the office sector has reported negative total returns. City offices was the most resilient subsector reporting the smallest decline in capital values (-0.6%) and total returns (-0.3%). In contrast, Outer London and M25 offices performed worse than the sector average with capital values falling -2.1% and total returns of -1.7%.

The industrial sector has fared very similarly to offices over the course of March. Capital values fell -1.6%, rental values increased 0.1% and total returns were -1.2%. March 2020 was the first month in which industrials experienced both negative capital growth and total returns since July 2016. There was a clear regional divergence in performance with industrials South East reporting capital value growth of -1.0% compared to the -2.5% for the Rest of the UK. Total returns for the rest of the UK were -2.1% compared to -0.7 in the South East.

Toby Radcliffe, Research Analyst at CBRE said: ‘The CBRE Monthly Index gives the first real-time glimpse into the impact of Covid-19 on UK real estate valuations. At the all property level, capital values fell by -3.0% in March. Monthly falls of this magnitude are extremely rare, unprecedented outside of the Global Financial Crisis and the immediate aftermath of the Brexit vote in 2016. In the latter case values fell by -3.3% in July before returning to growth by October. In 2008 on the other hand, Lehman’s collapse in mid-September presaged a -2.8% fall in values for the month, followed by falls of more than -4.5% in each of the following three months. The scale of the current Covid-19 crisis and its impact on GDP has far more in common with the GFC than with Brexit; it remains to be seen if real estate will behave similarly.’