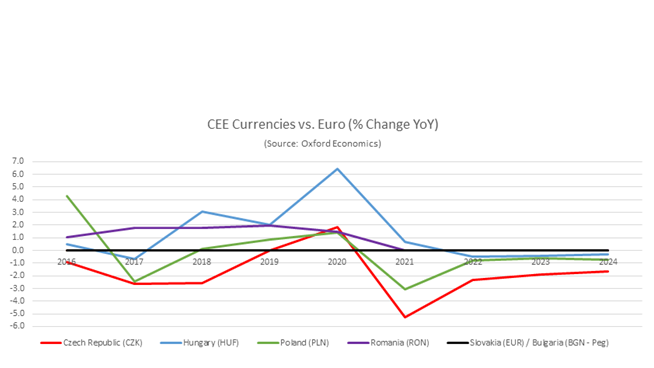

Countries that have not adopted the Euro, or are not pegged to it, have on average seen a 10% depreciation in currency value during the period February to March 2020, according to a new report from Colliers.

The Romanian Leu is the exception, depreciating just 1% - largely due to central bank intervention.

As the majority of leases in CEE are Euro denominated, the issue is placing additional strain on occupiers, particularly those whose income derives from local currencies (CZK, PLN, HUF & RON).

Kevin Turpin, Colliers regional director of research CEE said: 'On top of the forced or voluntary operational closures for retail, F&B, entertainment, hospitality, offices and some manufacturing and production facilities, to safeguard people’s health, this puts both landlords and tenants in a very unfortunate predicament.

'This is indeed uncharted territory, as the pandemic and subsequent states of emergency are restricting ‘business as usual’ for so many individuals and businesses. Therefore, reaching a mutually ‘best of a very bad situation’ compromise is surely one way to help protect all of our interests in the long run.'

Luke Dawson, managing director and head of capital markets CEE added: 'Loan repayment holidays and/or other financial measures, including government aid packages across the region are hopefully in the making and until these are more clear, it is essential that we find workable solutions that will work alongside these, assuming of course that whatever support emerges will not provide a "miracle cure".'

Dawson added: 'Rather than go head-first into legal disputes over payments, we are seeing the first cases of landlords considering short term rental holidays or bringing forward any contracted rent free periods (typically added at the end of a lease).

'In return, tenants could be expected to increase their lease lengths by the compromised period or more.'