Rental growth is the cherry on the cake that is rewarding investors who have bet on the Spanish recovery, experts agreed at the PropertyEU Iberia Investment Briefing, which was held in London this week.

‘Investors are attracted by the potential for rental growth in the short and medium term,’ said Reno Cardiff, international partner and head CMG business space at C&W Spain. ‘We are seeing more confidence on the part of occupiers, who are taking up more space. But tenants now want quality.’

Rental growth is coming back because stronger economic fundamentals and a stable government have led to more confidence in the market. Tourism has played a big role in Spain’s improving fortunes, Cardiff said: ‘It is now the third country in the world in terms of tourist numbers. Last year it attracted 75 million people, with a positive effect not only on GDP but on retail, hospitality and residential.’

The office sector remains strong but it is competing with other in-demand sectors, he said: ‘In Barcelona 10% of the office market has been bought for conversion into resi and hotels, which is an enormous percentage.’

Logistics in demand

The logistics sector is also one to watch, Cardiff said: ‘E-commerce is growing, and Amazon has just opened its Southern European base near Barcelona. Logistics demand is at an all-time record level, but things are still developing. It is more of a short-to-medium term investment than a short-short term one.’

In the cities the problem is lack of product and space, he said: ‘Madrid and Barcelona are very different markets to the rest of Spain, with very limited amounts of development space available. For logistics development opportunities we are now looking at Valencia with its port, and at the massive transformation going on in Malaga.’

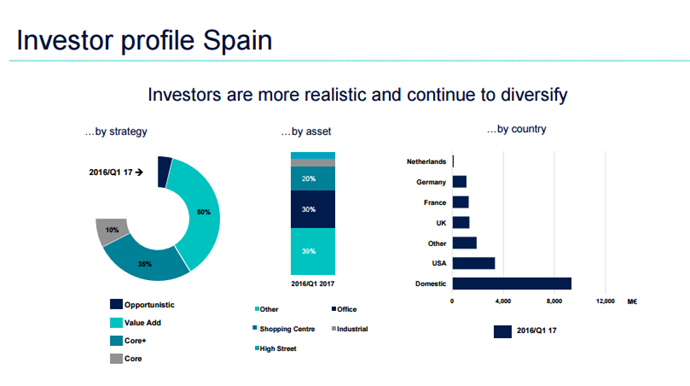

The message is clear: Spain remains a strong destination for both domestic and international investors, said Cardiff: ‘Investment volumes in the first part of the year were €4.2bn, and we expect that figure to go up to €11bn by the end of 2017. The total is lower than last year, but it takes into account the fact that there are less corporate transactions.’ Investments from continental Europe have more than doubled, from less than 10% of the total to 20% now, while Chinese and Malaysian capital is now targeting Spain.

The type of capital targeting Spain has changed, with less distressed and opportunistic funds in the market and more core and core-plus investors. Key cities and prime locations are also preferred, said Paulo Sarmento, principal at Meyer Bergman: ‘There has been a big shift and people now are a lot more sceptical about secondary locations and want to focus on prime markets.’

Investors who have bet on Spain have been rewarded. Looking at property performance returns in Europe in the last 10 years, Spain is second on the list after Sweden with a 13% return, followed by Ireland and then Portugal with 12 per cent. Returns so far have come from yield compression rather than rental growth, but that is about to change.