Real estate investment in the Nordic countries is expected to beat last year’s record in 2017 as target allocations are set to increase further, delegates heard at PropertyEU’s Nordics Investment Briefing, which was held in London on Tuesday at The Lansdowne Club in Mayfair.

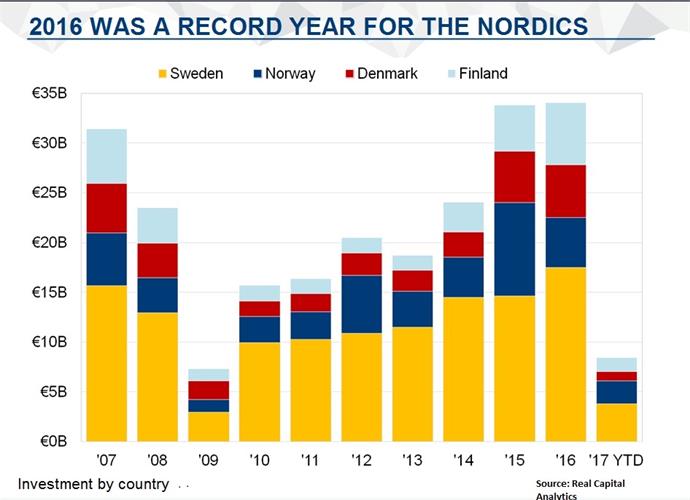

‘Investments in real estate in the Nordics almost reached the €35 bn mark in 2016, making it a record year,’ said Tom Leahy, director of market analysis for EMEA at Real Capital Analytics (RCA). ‘Looking ahead we can count on more capital coming in this year, as all foreign investors say they are interested in the market and want to increase their allocation.’

The biggest investors in the Nordics come from the UK, followed by the US and Germany. ‘The Asian players, who have made such waves in Britain, Germany and elsewhere in Europe in recent years, seem to be conspicuously absent,’ said Leahy, although this is at least in part due to the fact that these relatively small markets rarely offer the kind of big-ticket deals that Asian investors are interested in.

Competition from domestic players

Foreign investors who knock on the door find themselves facing formidable competition from domestic players. ‘Money from the Nordics really drove investment volumes last year, as 85% of the capital deployed was domestic or intra-Nordic,’ said Leahy. ‘The region bucks the trend seen in the UK, Germany and other EU markets, where foreign investors are increasing their presence. Of all the foreign capital spent in commercial real estate in Europe, the proportion going to the Nordics peaked at 9% in 2015 and has been falling since.’

Looking at the picture in more detail, though, the differences between countries come to the fore. While Sweden, the biggest market, is dominated by domestic players, foreign investors have more of a presence in the other three countries. ‘Over the last 12 months 60% of deals in Sweden have been domestic only, while in Denmark and Finland there is significantly more cross-border involvement, closer to the European average which is a 50/50 split,’ Leahy said.

Copenhagen top market

For the last three years Copenhagen has been the top market in the region for foreign investment, ahead of Stockholm which is a much bigger market but dominated by domestic investors. However, it should be noted that the top cross-border investor in Denmark has been Sweden: intra-Nordic investment is booming, driven by Swedish funds.

Foreign investors, however, are not deterred, said Andrew Smith, partner at Catella: ‘Last week we were marketing a €300 mln opportunistic portfolio in Denmark and had a significant number of bids, 80% of which were from foreigners. There is still a strong interest in the Nordics from private equity houses and foreign capital, but Denmark is easier to invest in than Sweden.’

Another important factor to take into account is that there are significant amounts of foreign capital invested through local funds, said Rykke Lykke, managing director of Patrizia Nordics. ‘For example in the statistics Niam counts as Swedish because the management is, but much of the money comes from the US and Europe,’ she said. ‘There are a lot of investments made with foreign capital through funds with a local presence.’

Graph: Nordic investment volumes (source: Real Capital Analytics)