Capital is continuing to pour into European real estate but cities rather than countries are becoming increasingly important as investment destinations, delegates heard at PropertyEU's European Outlook H2 Investment Briefing, which was held in London on Thursday.

‘In the last five years institutional money going into real estate has doubled, and that trend is set to continue,’ said Damian Harrington, head of EMEA research at Colliers International. ‘Despite low yields, the stability of real estate is attractive to investors.’

The macro-economic context is positive for Continental Europe, with growth coming back and overtaking a slowing UK. Investors are further reassured by the persisting wide yield gap with bonds. Interest rates are likely to remain at record lows in the UK and in the European Union, said Harrington: ‘The forces that are driving interest rates down are stronger than the forces pushing them up. Low yields are sustainable.’

From a country point of view Germany is the winner in Europe: it overtook the UK in terms of investment volumes in 2016, and has strengthened its lead in Q1 this year. This shift is likely to be accentuated in the next few months by political instability in the UK and the uncertainty over Brexit.

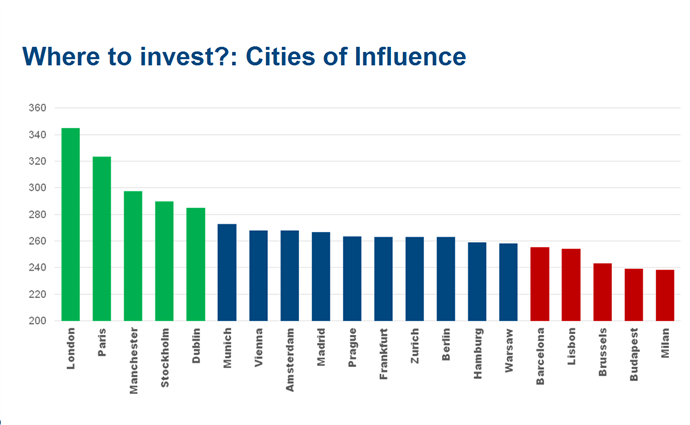

Germany is also number 1 in Colliers International’s rankings of countries based on a range of factors like political risk, demographic trends, economic growth, safe haven status and so on. However, in the ‘cities of influence’ rankings, London is first, followed by Paris, Manchester, Stockholm and Dublin. German cities are not in the top five.

London has few rivals

Looking at what investors want, London has few rivals, despite the uncertainty. ‘Politics is not everything when it comes to real estate investment decisions,’ Harrington said. ‘The top cities are attracting occupiers and this is where the investment will go. London and Paris are far ahead in their ability to attract talent and investment.’

Looking at sectors, retail is facing some serious challenges and the office sector is seeing a fall in investments and ‘more reconfiguration of offices than new demand’, Harrington said. In the hospitality sector, customers’ search for an experience is leading to demand for the upscale luxury offer at one end and the budget offer at the other end, while ‘the middle is having problems.’

Looking ahead, ‘the best opportunities are to be found in residential and in industrial and logistics because of their disruptive and defensive qualities,’ Harrington said.

An understanding of demographic trends is important in order to make the right long-term investment decisions. For example, the working population in Europe is expected to decline after 2030, but there are significant changes between countries. Poland and Italy will see the biggest declines, while the UK and the Nordics will go against this trend and record population increases.

‘In most countries there will be fewer young people and more old people, so senior living is set to overtake student housing in importance over the long term,’ said Harrington.