Intense competition for assets and price increases in the four Nordic markets are leading investors, both foreign and domestic, to widen their search and deploy their capital in all sectors and all areas, experts agreed at PropertyEU’s Nordics Investment Briefing.

The Nordics' capital cities feature prominently in the European rankings of investors’ favoured destinations, with Copenhagen at number 6, Stockholm at number 8 and Oslo at number 12. However, the reality is that it can be difficult to find and buy assets, and that the cities have become increasingly expensive because of high demand.

Prices in Nordic A-cities are 20% above their previous peak and they are now well above Amsterdam and even above the German A-cities. They are now on a par with Paris and just below London.

‘There is a lack of product across the board, and competition leads to high prices,’ said Stephan Bottger, director of international transactions at Corpus Sireo International. ‘We are focused on offices and on the main cities in the Nordics, but we have found very strong competition from local funds. No one is waiting for German money: that is something to keep in mind.’

Beyond the big cities

In the major metropolitan areas it can be difficult to access stock, often due to a concentration of domestic holdings, so ‘there are significant amounts of cross-border capital now going outside the big cities’, said Tom Leahy, director of market analysis for EMEA at Real Capital Analytics.

Foreign investors are also very good at spotting pricing opportunities, he said: ‘They are very aware of currency fluctuations and are always on the look-out, ready to pounce when it is most convenient.’

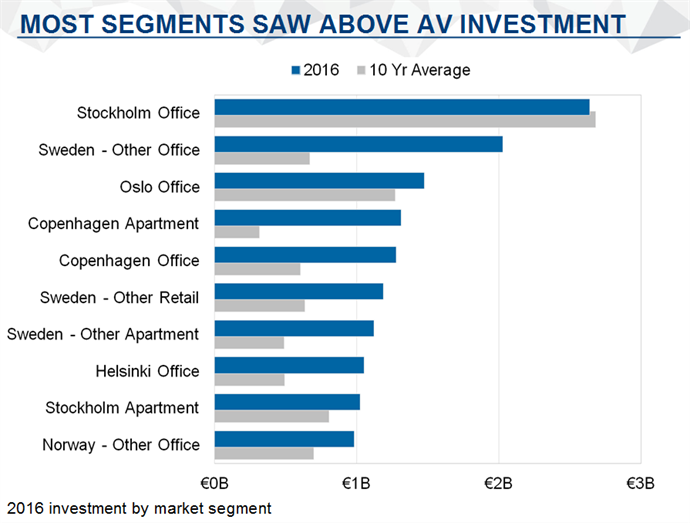

Investors initially target the most traditional sectors, but as the market gets tighter they have become more flexible. Stockholm’s office sector is the biggest segment of the market in terms of transactions, followed by offices elsewhere in Sweden, offices in Oslo, residential in Copenhagen, Swedish retail and Swedish residential, according to Real Capital Analytics data.

Yet the office market is one of the most difficult to crack for foreign investors because most stock is in domestic hands and held very tightly, especially in Sweden. It also offers lower returns, with yields of 3.7% over the last 12 months, well below the historical average.

Residential has been a better bet for investors, said Rikke Lykke, managing director of Patrizia Nordics: ‘Resi has been the property equivalent of the little black dress, providing steady cash flows. The top ten cities in the Nordics all lack residential, there is development going on but it is never enough to meet demand. There is a constant lack of supply for rented accommodation and virtually no vacancies. The situation will not change, because whatever the future holds, people have to have somewhere to live.’

Alternative asset classes

Micro-living has been the segment where rents have increased the most, she said, due to high demand from students and young professionals. Investors are also looking at alternative sectors like hotels, which are in great demand, and senior living and healthcare, which will become more sought-after assets due to a rapidly ageing population.

Logistics also has a definite place on investors’ radar screens, not just because of the rise of e-commerce but also because of the strength of long-established local companies, from Ericsson to Skandia and from the Lego Group to Husqvarna, that are champions on a global scale.

‘There are tremendously powerful distribution networks, especially in Sweden,’ said Andrew Smith, partner at Catella. ‘There has been a dramatic interest in logistics in the Nordics, which is set to continue.’