Germany is witnessing intense competition not only between investors looking for real estate opportunities but also between individual asset classes, experts agreed at PropertyEU’s Germany Investment Briefing, which was held this week in London.

‘There is strong competition between sectors now, adding a new dynamic to the market,’ said Marius Schoner, country head, CBRE Global Investors Germany. ‘Office buildings are competing with residential, light industrial with residential and with urban logistics. It is difficult to find development land in the main metro areas, and this is driving up prices.’

The most notable price rises – both of assets and rents - have been seen in the residential sector, due to the combination of limited supply and unprecedented demand driven by urbanisation.

‘The resi play is attractive because Germany is an awakening giant,’ said Karsten Kohlmann, managing partner at Waterway Investments. ‘People have traditionally rented all their lives, but they are now waking up to the opportunities of buying their home. This investment will continue and change the market.’

This new trend for private investors to buy, facilitated by the availability of financing, is spilling over into other sectors, said Christian Bodtke, investment executive at ESTAma: ‘Residential has a lot of potential, but we also see more tenants keen to buy buildings, especially in the retail sector, and they can get 100% financing.’

High street prices are falling ‘for the first time in a long time’, he said, and retailers are downsizing. There are signs that the retail sector is experiencing difficulties. ‘Retail assets will feel the pinch because of e-commerce,’ said Schoner, and urban logistics is a fast-growing sector.

Video highlights from the Germany Investment Briefing

Alternative assets

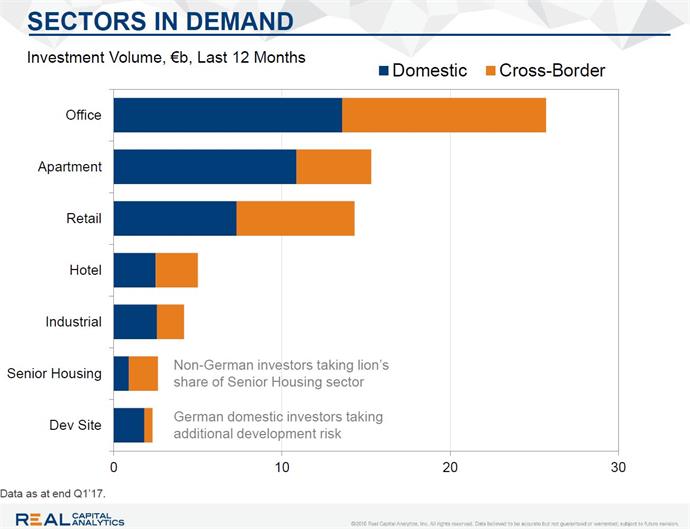

Alternative sectors are increasingly in demand. ‘Senior housing is up and international investors are taking the lion’s share of the sector, while in development it is domestic investors who are the most active,’ said Simon Mallinson, executive managing director of EMEA & APAC at Real Capital Analytics (RCA).

Offices are still the most sought-after asset class in Germany, with interest equally divided between domestic and international investors, followed by residential and retail, according to RCA research. In fact at a European level German offices have topped investors’ wishlist for the last two years.

The expectation is that the office sector will benefit further from the Brexit effect, the expected relocation of banks and companies from the UK following the country’s decision to leave the EU. ‘Germany will benefit from Brexit,’ said Kohlmann. ‘It will be mainly Frankfurt profiting, but Berlin as well, because whereas it was once seen as a government-only place, it is now a vibrant hub for companies.’

The change is already happening under the radar, said Schoner: ‘Banks are asking for bank licenses, big searches for 5,000 m2 offices are going on. After months of talk, we are now beginning to see actual movement in Frankfurt.’

But the impact of Brexit should not be over-estimated: ‘There are now 70,000 bank employees in the city. There will be 5 or 10,000 more but their number will not double. It will have a big impact on the city, to be sure, but Frankfurt will not become the new financial centre of Europe overnight.’