Portugal is now firmly on international investors’ radar screens and the outlook for the country’s property market is positive, panellists agreed at PropertyEU's Iberia Investment Briefing, which was held in London this week.

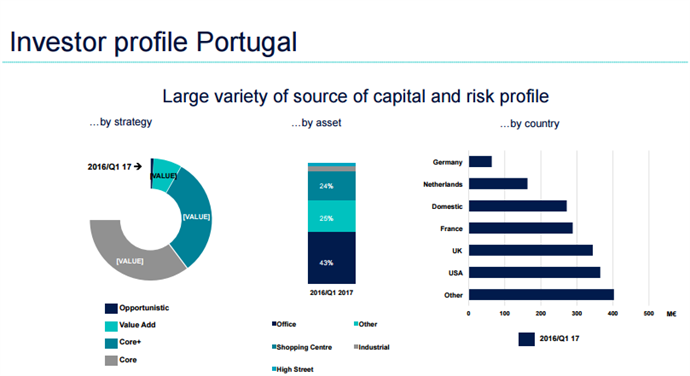

‘Capital is coming in from all over the world, from Singapore to Brazil, from the US to South Africa, which is a big change,’ said Eric van Leuven, director and head of Portugal at Cushman & Wakefield. ‘Investors are attracted by yield compression.’ The year has started so well that C&W are predicting investment volumes will reach €3 bn by the end of 2017.

Unlike Spain, Portugal relies mainly on investments from abroad, he said: ‘A shortage of domestic capital opens up good opportunities for foreign investors. Banks with non-performing loans and insurance companies are continuing to deleverage. Some large portfolios will come to the market in 2017.’

The opportunities are mainly in the well-performing sectors like office and retail, but alternative sectors like hotels, hostels, student housing, healthcare and even parking are generating a lot of interest. Retail continues to be a success story: it is the only sector where rents are higher in Portugal than in Spain, and they are still rising, especially in the country’s vibrant shopping centres.

A stronger economy is leading to a surge in demand for offices, especially in Lisbon and Porto, where demand is highest but there is a lack of quality stock. GDP growth, at 2.8% in Q1, has surprised on the upside, being higher than government or IMF forecasts. ‘Office rents have been flat for so long that it is difficult to persuade investors, but mark my words, there will be rental growth in the office sector in the next few months.’

Positive fundamentals

Investors who come to Portugal are not disappointed, said Joao Torroaes Valente, counsel at Uría Menéndez, as the investment climate is positive, occupier markets are strong, the tax environment is benign and the government stable. ‘Two years ago there were concerns at the centre-left coalition coming into power,’ he said. ‘But now everyone can see that it is working well and the economy is growing.’

What has happened in Portugal is ‘extraordinary’, said Van Leuven: ‘The government has strengthened the economy and supported the recovery. The climate has improved, thanks to a combination of good luck and good policies.’

The next positive steps could be the creation of a ‘bad bank’ and the green light for REITs. The government has said that the legislation to create a Portuguese version of the highly successful Spanish SOCIMIs will go ahead, and the market is hoping it will be approved by parliament before the end of the year.

The government also says it is working on a plan with the Central Bank and the European Central Bank to create a platform to manage Portuguese banks’ NPLs, which amount to €3.5 bn. ‘It is a massive undertaking,’ said Torroaes Valente. ‘We may follow the Spanish or Irish model, which worked in those countries, or go for an Italian-style solution, or opt for a mixture of the three. What is important is that it will be positive for the market and there will be more liquidity.’