Good quality assets are still coming to the market and trading at pre-Covid-19 prices, despite a slowdown in investment activity. But for how long? Simon Mallinson, executive managing director EMEA & APAC at Real Capital Analytics, takes stock.

The coronavirus pandemic could, in some respects, be the perfect storm for real estate. Physical restrictions prevent property viewings and the economic fallout provides enough uncertainty to limit deal-making at a time when property prices are at record levels in many markets.

Global real estate transaction volume fell 51% year-on-year in the second quarter to the worst quarterly level since Q2 2009, as the pandemic slammed economies, upended normal ways of doing business and cast a shadow on future demand for some property types.

When did it all go wrong?

It was all very different at the start of the year, as our cumulative daily tracker shows. Through the end of March, US activity was tracking well ahead of 2019 and 2018 levels, and in Europe it was on a par with the recent high-water mark of transaction activity set in 2018. The warning signs were on display in the Asia-Pacific region much earlier. This is clear from the daily tracker. Transaction volume soon fell to around 40% of 2019 levels and has progressed at that shortfall throughout the year.

The Covid-19 lockdown put the economies of the world on pause, but, like the onset of the Global Financial Crisis (GFC), investors were in the dark as to how it would unfold and impact long-trusted property sectors.

Some trends were more predictable than others. Sectors that already had wobbles, such as retail and hotels, have clearly fallen further out of favour. Sectors that allow the delivery of goods to locked-down families, are clear winners. But who would have foreseen the impact on offices, the stalwart of institutional portfolios? Or the desertion of cities such as Manhattan and San Francisco by the knowledge workforce, leaving behind empty apartments that a year ago would have been snapped up by renters.

Investors will be spending the next few quarters rebuilding their allocation models to try and make sense of the new normal and how to take advantage of the opportunities that will, in time, arrive.

Where does that leave Europe?

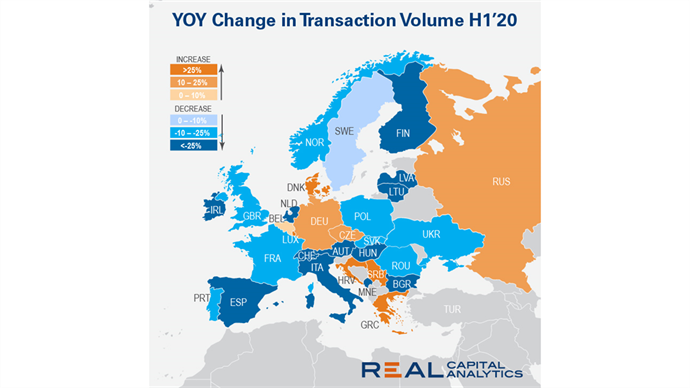

The Covid-19 pandemic and associated lockdown caused quarterly transaction activity in Europe’s commercial real estate market to drop to the lowest level since 2014. RCA recorded €50.1 bn of activity in Q2 2020, down 32% on the same period in 2019.

While this drop is shocking, volumes across Europe have held up much better than some other markets in North America and Asia Pacific. In Germany, Europe’s largest market, second-quarter sales volume edged up in comparison with the second quarter of 2019. Similarly, for Denmark, one of the European countries least afflicted by the virus, investment doubled from a year prior.

The main reason for Europe’s relative outperformance is the handful of supersized deals that have completed. Indeed, the deal count paints a more sobering picture. The tally of deals dropped 48% YOY in the second quarter to the lowest level since 2013. Volume for deals priced €250 mln and greater accounted for 40% of the quarterly total and were on a par with Q2 2019, whereas for deals under €20 mln, the total transacted dropped by 55%. The preponderance of these big deals also reflects the fact that entity transactions were at their highest level since the end of 2017. This was driven by Blackstone’s acquisition of the iQ student housing portfolio in the UK and the purchase by ADO Properties of fellow German listed landlord Adler.

The slowdown in smaller deals perhaps best represents the health of the market as a whole. These smaller deals tend to take less time to complete and are usually less complex. The fact that we have seen such a sharp slowdown here shows how quickly sentiment shifted when lockdown was imposed for most European markets in March.

For an array of industry participants, the slowdown in smaller deals is most worrying. These deals are greater in number and deliver a higher percentage fee than the larger deals. Without these deals, brokers, lawyers, consultants, lenders and other service providers will struggle financially. A healthy industry needs all these participants to be productive.

The larger deals tend to involve the very well-capitalized institutions, which have been encouraged to keep spending by the prospect of low interest rates for the foreseeable future, and a healthy stock market that is not causing any denominator effect as experienced after the GFC.

How are the European sectors holding up?

Investment into the apartment sector looks especially strong in Q2 2020 in comparison with Q2 2019 because of a series of very substantial platform deals. The largest of these were ADO’s acquisition of Adler and Blackstone’s iQ purchase, a deal that was agreed in February but only gained regulatory approval and completed in May. The quarter was also noticeable for a big deal in the French residential sector, which has attracted relatively little investment in comparison with other core European markets.

The financial protection afforded to citizens in many European countries mean the ability to pay rent has not yet been compromised by the pandemic. However, as the support is removed, it is likely unemployment will start to rise and may impact individuals’ ability to hand over rent. For student housing investors, the reduction of in-person university teaching, travel restrictions, and the worsening relations with China could negatively impact occupancy; this is especially true of the UK, where one in five university students comes from overseas.

Hotel investment plummeted in the second quarter, performing worse than all other major sectors. International tourism and business travel volumes will remain low while the hunt for a vaccine continues, putting operators’ business models and future cash flows in doubt.

The logistics sector is seen to be in a prime position to benefit from the forceful shift to online retail that the pandemic has precipitated. Additionally, with retailers changing their business models to cope with demand surges, there is increased need for distribution space. Logistics deals have continued to complete since Europe went into lockdown. Nevertheless, the sector could not escape the more general slowdown that the physical restrictions and economic uncertainties have engendered, and transaction volume fell by almost a third.

The pandemic is increasing the fragmentation of the retail sector. This breakup was underway well before Covid-19 struck, but the health crisis and lockdown have added fuel to these trends. Secondary retail looks increasingly vulnerable, while grocery and convenience have proved more resilient. Sales of grocery stores outstripped the rest of the retail sector combined in Q2 2020.

For the office sector, transaction cap rates show very little movement in comparison with the first quarter. The office market is the most difficult sector to read as it depends on whether the move to remote working will stick after lockdowns are eased and spur major occupiers to cut their footprints.

Are we in a liquidity crisis?

Domestic investment has held up better than cross-border sources, but the picture is not uniform. Quarterly spending in Europe by domestic players increased 13% YOY in Germany and France, whereas in the UK and the Netherlands, acquisitions plummeted by 53% and 47%, respectively.

UK investors have been notable by their absence in Q2 2020. It was the slowest quarter for investment from UK-headquartered players, at home and abroad, since Q2 2009. On an absolute basis, spending by regional and global cross-border investors on European real estate has fallen to its lowest level since 2013.

The restrictions on movement have naturally had a limiting effect on the ability of non-domestic investors to do deals when unable to conduct their usual due diligence. Property’s unique status as a physical asset has plenty of advantages, but in the current circumstances has proven something of a weakness for completing deals.

The sharpest slowdown was from investors headquartered outside of Europe. Acquisition volume fell 55% versus Q2 2019 and 40% versus the first three months of 2020. The biggest shortfall was from South Korean and US investors, both major sources in the market. Quarterly investment flows from Singapore, Canada and the United Arab Emirates were well down on their five-year averages.

RCA analysis shows that markets attracting a greater share of global capital have tended to see higher rates of price growth during this cycle. Of the largest markets, the UK and London seems more exposed to the slowdown in overseas capital. Post-GFC, this influx helped liquidity in the bigger UK cities, especially London, which enabled faster price recovery.

The ongoing restrictions on movement may mean that this beneficial overseas capital flow may not move in to support pricing once markets reopen. In addition, worsening political relations with China would seem to limit or even preclude investment from Chinese entities and, by extension, Hong Kong firms. Hong Kong capital had helped London ride through earlier Brexit bumps. London’s exposure to cross-border capital may be its Achilles heel if domestic sources remain out of the market.

So, is this a liquidity crisis? Not yet. Good quality assets coming to the market are still fetching pre-Covid-19 prices. RCA’s Commercial Property Price Indices (CPPI), which are based on transacted prices, are showing little decline despite the slowdown in activity. That indicates prices achieved are not falling notably so far. Various capital raising surveys indicate that institutions are ready to invest.

However, if investors are looking for the same sort of discounted opportunities that came out of the GFC, they may well be disappointed. Owners remain well-capitalised and content to hold assets. Lenders are not forcing anyone to sell, yet. The situation may change if tenants start to buckle under the strain of extended economic lockdowns and investments lose that all-important cash flow. But that then becomes a problem not only for the current owners, but for their lenders, potential buyers, and the industry.