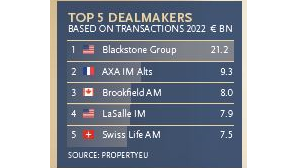

Our annual ranking of the biggest dealmakers in Europe based on transaction volume over 2022 puts Blackstone in the top spot, followed by AXA IM Alts and Brookfield Asset Management.

MAGAZINE: Top 100 dealmakers in Europe

- In Magazine highlights

- 11:10, 12 juni 2023

Premium subscriber content – please log in to read more or take a free trial.

Events

Latest news

Best read stories

-

Emaar Properties acquires Grand Hotel Imperiale in Forte dei Marmi

- 25-okt-2024

The Grand Hotel Imperiale in Forte dei Marmi, Italy has been sold to UAE-based real estate company Emaar Properties, owner of renowned buildings such as the Burj Khalifa and the Dubai Mall.