The Netherlands is the most popular real estate destination worldwide, when judged in terms of cross-border investment metrics.

This assertion was made by Mathijs Flierman, head of capital markets for the Netherlands at Cushman & Wakefield, during PropertyEU's Europe and the Netherlands Outlook 2018 briefing.

The event was hosted at the offices of CMS, an international law and taxation specialist, in the Atrium office building in Amsterdam on Wednesday.

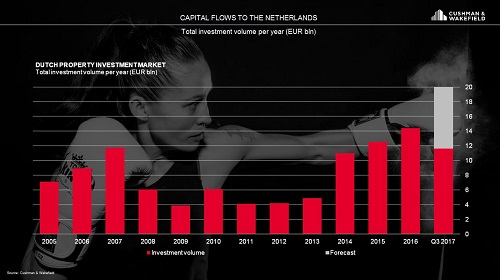

Flierman said Dutch real estate volumes for 2017 are expected to reach a new record of €20 bn. About half the amount comes from continental and global investors.

'If you take the volume of €20 bn and divide that by the total real estate supply in the Netherlands, the country would be by far the most popular country in the world to invest in for cross-border investors,' he said.

Flierman made his comments during a keynote presentation that preceeded a panel discussion. He noted that Europe is the most active market for cross-border investment (45% of total investments). This compares with cross-border shares of 15% each for North America and Asia.

Cross-border capital

Cross-border investors spent €132 bn on European real estate during the first six months of 2017. The largest part of that was done by European investors (69%) invested in Europe but not in the own country. About €39 bn came from the US, followed by Apac and the Middle East.

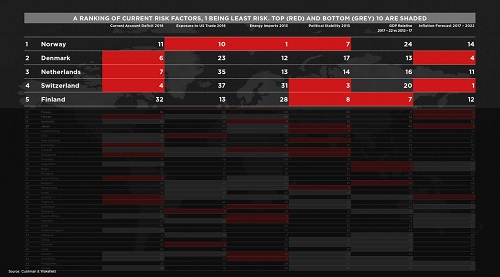

Cushman & Wakefield evaluated and compared 50 countries on the basis of six factors: current account deficit, GDP growth, inflation, trade with the US, energy imports and political stability. The Netherlands emerged as the third least risky market based on an overall average of the six factors.

The Netherlands stands in seventh place overall in a list of the 40 most popular countries for cross-border real estate investment. This puts the Dutch market behind the US, UK, Germany, France, China and Australia.

Investment picks

Besides Flierman, other members of the panel included Rogier Bos, head of real estate finance Benelux at Berlin Hyp; Maurizio Grilli, head of investment management analysis and strategy at BNP Paribas Real Estate and Reinoud Plantenga, director investment management for the Netherlands at Triuva.

When asked what their top investment choices were for Dutch real estate, Flierman said Cushman & Wakefield strongly believed in healthcare real estate. 'We now have six people in our dedicated team and we will expand that rapidly. That is investment for the future: not the next year or the year after, but it will come and then you need to be ready,' Flierman said. 'We have seen players who say I will act when the market is there and it is all happening. At that point I think you are too late.

'For the Netherlands I would heavily invest in residential, senior living and healthcare real estate,' Flierman said.

Grilli of BNP Paribas Real Estate said the advice to investors was to use geographical diversification to boost risk-adjusted returns. 'That said, there are both cyclical and structural factors that support sectors we particularly like, such as offices, logistics and alternatives including healthcare and senior housing,' he added.

For investors with a large amount of capital to invest, Bos of Berlin Hyp said he would recommend residential. Bos: 'It is actually the only asset class where there are no bad stories behind it. It is purely positive,' Bos said.

If looking to invest a smaller amount of capital, Bos suggested looking at good quality offices in the top 20 cities outside of Amsterdam. Triuva's Plantenga agreed, saying he would first look at offices and residential in Amsterdam. 'I would also not forget about other cities, especially in the Randstad (conurbation). Rotterdam, Utrecht and The Hague are well connected to each other and Amsterdam,’ he said.

‘These cities are all 20-40 minutes by car or public transport from each other. In terms of area it is smaller than London or the Ruhr area. We have already seen yield compression in these cities which will receive money as there is not that much product available in Amsterdam,' Plantenga said.