A top tier of Europe's major business centres is poised for office rental growth in the aftermath of the Brexit vote, according to advisor Gerald Eve's latest European Property Market Brief published for Mipim.

Cities including Amsterdam and Paris will build on recent gains to drive further rises in office rental values, the report says. Currently stable business locations – such as Frankfurt, Luxembourg and Munich – are readying themselves for future growth as firms may seek to relocate employees in the wake of the UK leaving the EU.

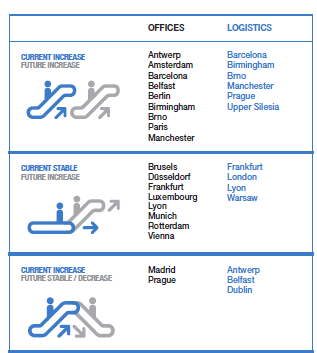

The report, which draws on data from Gerald Eve's international alliance partners, includes a 'property escalator' (pictured) to track current rental growth trends and future rental prospects across Europe’s major office and logistics markets.

It reveals a continental office market in rude health, with the vast majority of cities anticipating growing or stable rents – indeed, only two centres (Warsaw and Istanbul) are expected to see falls over the coming year.

It is a similar story with industrial and logistics property, with no locations looking ahead to decreasing rents in the sector during 2017.

Barcelona is once again showing particularly strong prospects, with rents for both offices and logistics property having increased in 2016 and forecast to rise again over the coming 12 months. It is joined in this category by Birmingham and Manchester in the UK, and Brno in the Czech Republic, all of which are facing shortages of the best space in both sectors.

Patricia LeMarechal, partner at Gerald Eve, said: 'This snapshot of European real estate shows a market that has grown in confidence over the past year and has a positive outlook for both office and industrial space. The Brexit vote has clearly improved prospects in those major office markets that are well-placed to capitalise and attract staff, while a general continent-wide lack of industrial space can be seen in the upward pressure on rents in nearly all locations.'

The research analyses the current performance and future prospects of industrial and office space in 24 cities across 13 European countries.