More than half of hotel investors have stopped seeking deal opportunities because of the coronavirus crisis, new research shows.

Just 41% of hotel inivestors in the EMEA were seeking potential transactions in mid-March, when occupancy rates in hotels across Europe had plummeted as tourists stayed away from cities in lockdown and business travel dived as staff began working from home.

Global property services firm, Cushman and Wakefield found that during the first two months of the year, year-to-date figures for European hotels showed positive growth of revenue per available room (RevPAR), due to increase of average daily rate (ADR), despite A minor decline in occupancy.

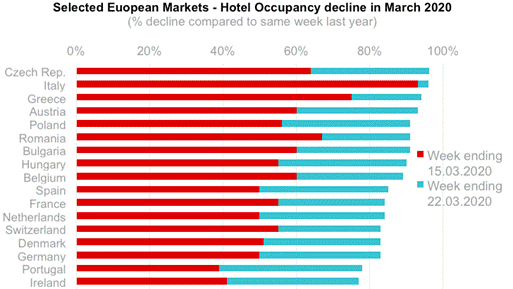

But after this solid start to 2020, Europe was hit by the Covid-19 crisis and occupancy levels nosedived to current comatose levels. At first, some markets such as the UK were less affected than others. But the majority of hotels are now closed across the continent, except at some airport locations.

As a result of coronavirus, assets such as hotels and restaurants have undergone drastic changes of use, as part of efforts against Covid-19. Some hotels in Europe are operating as hospitals, quarantine facilities, shelters, temporary logistic spaces or even serve as temporary work locations with rooms being offered as private offices to those who struggle to work from home.

Meanwhile, some hotel restaurants are being used to produce food for delivery and staff are being re-deployed with delivery companies or in other sectors.

Jonathan Hubbard, head of hospitality EMEA at Cushman & Wakefield, said: ‘Despite the lockdown, some transaction and leasing activity continues across Europe and there are a number of equity rich agile investors seeking to take advantage of opportunities that will arise in the coming months to recapitalize stressed investments and acquire potentially distressed assets.’

Borivoj Vokrinek, head of hospitality research EMEA at Cushman & Wakefield, said: ‘Various stakeholders, including owners, operators and banks are engaging in finding compromise solutions including fee reductions or deferrals, reduced rent payments or rent holidays, as well as loan payment suspensions and new credit lines.

‘The focus for the hotel sector has been on finding temporary solutions to navigate this crisis, rather than drastic irreversible measures, and hoping for a recovery in the second half of the year. There is no doubt that government support across Europe will be critical for hotels to be able to overcome this crisis.’

Cushman & Wakefield interviewed 49 EMEA hotel investors in mid-March.