Billions of euros of real estate is expected to come to the market in Germany in the next few weeks as the country eases out of lockdown faster than European peers.

Peter Schreppel, CBRE’s head of international investment in Germany, said that business lunches, office client meetings and pitches had resumed in the past two to three weeks: ‘Normality is coming back to the German market, albeit at a slow pace. When I look across my office I see seven, eight, nine people; if we had spoken four weeks ago I would have seen two.’

He believes there is €4 billion of office property alone in Germany, ‘that was kind of on hold. It is all going to be brought to the market over the next few weeks because everybody here seems to have the view that Germany is back to normal enough to relaunch them.’

He added: ‘None of it is fire sales; it is almost all core or core-plus investments.’

Alexander Kropf, head of the capital markets group in Germany at Cushman & Wakefield, said: ‘It feels to us that, as with the moving back to work in Germany, the real estate market here is opening up first in Europe.’

A limited number of core deals continued to progress and close in Germany at the height of the coronavirus outbreak, in March, April and May. Some, like Patrizia’s €140 mln acquisition of a healthcare sale and leaseback portfolio, let on 20-year leases to Advita, even set new record yields, in that case close to 4%.

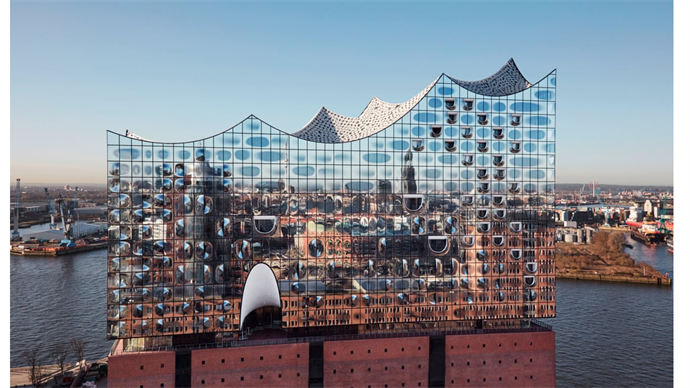

Union Investment’s acquisition of the Ericus-Contor office building in Hamburg was also a record price, even though it was a circa 3-5% discount to seller Patrizia’s original, pre-covid-crisis expectation.

German brokers agree that it is these sorts of core properties which will continue to attract strong prices, while buyers looking for value-add opportunities that require financing and capex to unlock reversionary potential will expect ‘corona discounts’.

Kropf said demand has not been interrupted for buildings with long income that appeal to long-term investors. ‘There is an investor base for Germany: German and other European pension money, insurance companies and open-ended funds which always invested long-term in core or core-plus yields.

‘This capital says that before (coronavirus) there was just so much competition with investors from around the world. Now the competition is not there, they are able to do deals.’

Value-add pricing remains hard to gauge

Kropf believes that pricing for opportunistic property is harder to gauge. If, as German real estate owners hope, the strong rental growth of recent years continues, sellers who do not need to sell now may wait because they know the values they are sitting on.

‘We had record yields before coronavirus because of the reversions - 1.7% in Berlin for example. That seems to be impossible at the moment because a more aggressive business plan to unlock the reversion cannot get the 60%, 70% or 80% LTV financing. This is just not coming back for these investors yet, and their cost of capital means they can bid 30%-40% less’, he said.

Like other agents, Cushman believes the pipeline of investments is large. ‘A lot of the deals that we pitched at the beginning of the year stopped in March and were postponed. Those deals might come back to the market now - in June/July - or after the summer,’ Kropf added.

‘There are deals being prepared, with 15-year leases and government-backed tenants where we expect to see huge interest.’

Commentators say that the rebound in Germany’s economy has been impressive, with restaurant bookings returning to normal levels in early June and trips to shopping centres and bars only 20% below pre-crisis levels, compared to the same early June period a year ago.

On 10 June, the OECD said that Germany’s economic downturn due to the pandemic had been moderated by the country’s ‘widespread testing and high health sector capacity.’