The global property investment market saw volumes rise 4% year-on-year to US$1.5tn (€1.3 tln) in the year to June, according to new research published by Cushman & Wakefield at Expo Real.

'Winning in Growth Cities', an annual report examining global commercial real estate investment activity, ranks cities by their success at attracting capital.

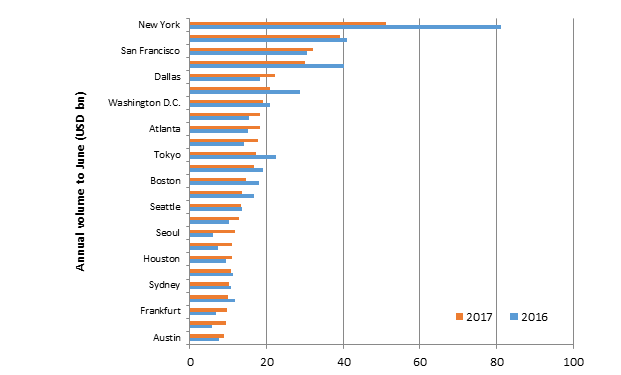

During the 12 months to June 2017, the top 25 cities globally accounted for almost half of the market but some sharp falls were seen in traditionally dominant cities. New York remained the most sought-after market for the sixth year running despite investment dropping 37%, while a 25% decrease saw London lose its top three status and Paris witnessed a 21% decline. A lack of available assets was a key factor in these declines.

Relative winners included San Francisco which entered the top three thanks to 4.5% growth and Hong Kong with 19%. At the same time, Tier 2 cities, such as Malmö, Nice and Osaka gained importance through increased international interest as investors cast their net more widely in search of better returns.

North America held its strong grip as the leading region for total investment, with 13 US cities ranked in the top 25 and six each from Europe and Asia Pacific. Cities in the latter region experienced some of the most dramatic growth. Seoul saw volumes increase by 98%, and Singapore 52%.

David Hutchings, head of EMEA Investment Strategy, Cushman & Wakefield, and author of the report, said: 'The strong global growth is perhaps something of a surprise given the headwinds faced by the market in 2016 but investor sentiment has definitely improved. With fears of a rise in populism taking a back seat, at least for the moment, globalisation in the real estate sector continues apace.

'The falls in activity seen in some leading cities reflect a lack of available opportunities more than fall in demand, but it is also true that rising prices are encouraging some investors to broader their horizons.

'While the ability of New York, Tokyo and London to adapt and reinvent themselves will continue to reinforce their global hegemony, competition is heating up with investors' attention landing upon a broader range of Tier 2 cities. Eighteen markets which were not targeted by cross border investors in 2015/2016 are now making gains, an indication of investor willingness to move into new markets.'

EMEA region

Central and Eastern European capitals fared best in terms of overall growth with volume growth in Prague, Budapest and Sofia in particular outpacing Western European cities. Similarly, confidence grew in Athens, albeit from a low base, with volumes reaching a 10-year peak.

Ten of the top 25 global cities attracting international investment were in Europe with London, Paris, Amsterdam and Berlin all in the top 5. A number of German cities rose up the rankings with Berlin moving up two places and Frankfurt climbing nine places over the year to rank within the top 10 recipients of cross border capital. Interest in Frankfurt was particularly notable among investors from Asia and the Middle East with volumes up 461% and 132% respectively.

For the first time in four years, European capital was the greatest source of total cross border investment, surpassing even North America.