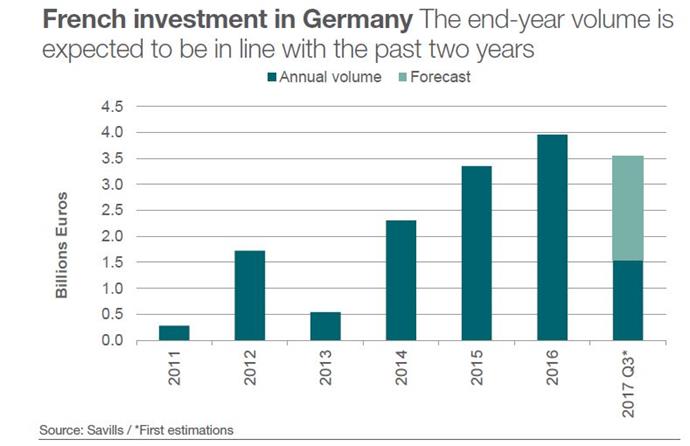

French investors have spent €1.5 bn on German commercial property in H1 2017, up from €1.4 bn in the same period in 2016, accounting for 10% of all foreign capital invested in Germany, according to Savills.

Activity by French investors has been particularly strong this year, says Savills, as 2016 volumes were inflated by the completion of a few large portfolios, including the acquisition of a hotel portfolio by Fonciere des Régions and the acquisition by Primonial of a large care home portfolio.

While previously most French investors concentrated on retail and office assets, activity has now diversified into the alternative classes as competition intensifies for German assets with higher yields and opportunities to produce income, according to Savills.

French investors are being driven to invest abroad as the increasing popularity for domestic assets has seen French commercial property become the most expensive in Europe. Prime office yields in Paris have now fallen to 3%, compared to 3.1% in Berlin and Munich, 3.3% in Frankfurt, 3.4% in Stuttgart, 3.5% in Hamburg or 3.7% in Cologne, says Savills.

Prime opportunities within France are increasingly scarce, says as inflows into French open-ended funds – the Societé Civile de Placement Immobilier (SCPIs) – doubled between 2011 and 2016, from €27.8 bn in 2011 to €55.6 bn in 2016. As such in H1 2017 over 50% of French capital was allocated elsewhere in continental Europe – the first time this has happened since 2007.

Lydia Brissy, director in Savills European research: 'Traditionally French investors have been domestically focused, but the sheer weight of capital currently in the market means that they are having to deploy elsewhere. Given the French largely prefer to avoid currency fluctuations by remaining within the Eurozone and favour core countries, Germany is the ideal destination with its close proximity, strong property fundamentals, low office vacancy rates and competitive yields.'

Boris Cappelle, director and head of investment Savills France, added: 'With yield compression and a lack of prime product available in Germany, the French are starting to seek new destinations within the Eurozone, particularly Spain, the Netherlands and more recently Italy. However, due to its market size, proximity and stability, Germany will remain a country of choice for French investors for some time to come. We expect that by the end of the year French investment volumes in Germany will be around €3.5bn, in line with the €3.4bn recorded in 2015 and €3.9bn in 2016.'