Germany overtook the UK as the most active country for investment in commercial real estate in Europe in H1, although the UK fought back in Q3 and Spain is becoming increasingly attractive according to a new report from global real estate advisors, Colliers International.

Overall, the report, 'Capital Flows: Developing not Cooling', demonstrates that capital flows into real estate globally remains very strong, with 2017 H1 acquisition levels at $611 billion matching those of 2016 and 2015.

However, this masks a strong divergence trend between regions with investment volumes in Asia Pacific firmly on the way up, driven largely by the re-orientation of Chinese capital, whilst activity in the Americas and EMEA continue to show signs of late-cycle cooling.

'Despite regulatory controls, Chinese capital looks likely to remain a feature of the investment landscape globally, but the focus of spending differs by global region. In Asia Pacific there is a much stronger focus on land and development, whereas in Europe the focus is on income producing assets in primarily core markets,' said Richard Divall, head of EMEA cross border capital markets at Colliers International.

'Germany led the market in H1 2017 in terms of investment volumes with €33 bn recorded; a 34% year-on-year increase, however the UK has fought back in Q3. German cities form six of the top twelve destinations for capital in Europe (and eight of the top twenty) and the 'distribution diversity' this presents, alongside the ongoing economic and regulatory strength of the economy, should help drive another successful close to the year and offers a strong outlook for 2018,' Divall explained.

'Bearing in mind how the depreciation of the sterling to the euro has impacted UK investment volumes relative to euro-denominated markets like Germany, the lack of clarity over the future path of Brexit is clearly not deterring investors,' Damian Harrington, head of EMEA research at Colliers International, added.

Spain heats up

The report also reveals that outside of the UK, Germany and France, the top areas for investment are in Benelux, Spain and the Nordics.

'Spain is making big strides towards recovery thanks in part to the strong economic performance that has been driven by a growth in exports. Following a 50 per cent year-on-year growth in investment turnover, Spain received more investment than France in H1 2017,' said Harrington.

'Much of the volumes can be attributed to Spanish REIT, Merlin Properties, which spent more than Blackstone in the first half of 2017 despite its focus on Iberia. Retail space is the most active sector and Madrid is storming up the city rankings. Whilst Spain has moved swiftly off a low base, the furore surrounding the recent Catalan independence vote may deter some investors from the market until the situation improves.'

City rankings

The top three cities for real estate investment remain unchanged year-on-year, with London benefitting from three times the investment volumes of either Paris or Berlin which are firmly second and third. Following year-on-year increases in commercial real estate investment volumes in Germany, Frankfurt has also risen to the fourth most active city. Madrid and Barcelona have also witnessed significant year-on-year increases in city rankings moving from the eighth to fifth and 23rd to 17th most active cities respectively.

Risk off environment

Divall commented: 'We are heading towards the growth end of the property cycle in Europe and we are seeing investors strategise and evaluate how to get stable returns in two to three years’ time in case there was a downturn. Secure income is popular and traditional strategies of buying in prime locations in liquid markets as well as property asset classes driven by global mega trends such as urbanisation and ageing population, are attractive'.

Winds of change

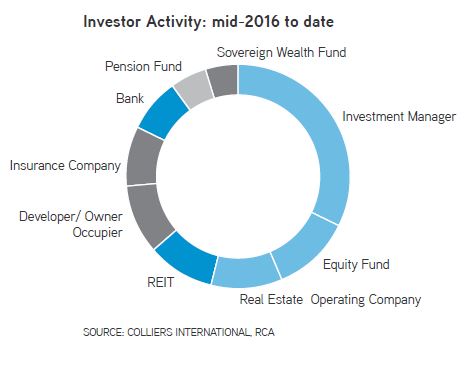

Of the investors themselves, Divall said: 'Investment managers are having an increasing influence over investment volumes, which is a big change since the last cycle when funds dominated the space. Investment managers including Patrizia; CBRE GI; Amundi; Invesco; TH Real Estate and M7 now account for over 30% of investment activity compared to only 19 per cent ten years ago. This is changing the nature of investment, enabling it to be more active and nimble. Investment banks are no longer a feature in the top 20 most active investors globally, yet they accounted for five of the top ten in 2007. The only consistent player is Blackstone.

'Since the EU referendum, there has definitely been a wave of capital moving to the continent; but this has largely been yield driven. Prices are clearly aligning with only a 200 basis points spread across the major European city markets. Many German cities now trade at prime yields lower than that of the London West End. Our analysis of the embedded occupier strength of markets continues to put UK cities in the top ranking markets, which could see capital redistribute once more.'

'Capital may be consolidating, but the way it is being spent in Europe is diversifying by sector. Residential is again the consistent grower and performer, accounting for around 15% of all activity in H1 2017 – some 2.5 times its market share in 2007. This still hasn’t reached the equivalent levels in North America, suggesting that there is room for further growth.

'The other notable shift is investment into development and forward-funding of projects. All the top cities have seen significant deals close on assets under construction, particularly for offices. Proportionately, offices have claimed back some ground over other sectors in H1 2017, even though volumes have shrunk marginally. Given the lack of modern, large-scale office space in many European cities, further investment into development is likely to drive the cycle on in 2018, especially when yields for standing assets remain so low.'