- Market Watch

- 28-sep-2016

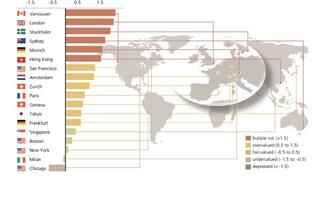

London tops European cities at risk of housing bubble

London is the European city most at risk of a housing bubble, according to the latest UBS Global Real Estate Bubble Index report.

Read moreLondon is the European city most at risk of a housing bubble, according to the latest UBS Global Real Estate Bubble Index report.

Read more

German real estate company IVG Immobilien plans to list its German office arm, Officefirst Immobilien - which holds assets worth more than €3.24 bn - by the end of the year, according to a statement released by Officefirst.

Read more

The Nordic hotel sector would benefit from more consolidation to create a ‘healthy’ hotel market, according to Peter Wiwen-Nilsson, who joined Nordic real estate group Brunswick Real Estate in September to launch its new hotel arm.

Read more

Suspended UK property funds need to ‘put themselves in a strong enough position to handle redemptions when they reopen’, Simon Molica, portfolio manager at Morningstar Investment Management in the UK, has told PropertyEU this week.

Read more

US private equity investor Oaktree Capital Management is gearing up to sell €550 mln of German commercial property assets, Boris Hardi, head of real estate at Sabal Financial Europe Germany, has told PropertyEU.

Read more

UK retail investors’ property fund activity has soared by 900% following the Brexit referendum in July, compared with the same period a year earlier, with outflows outweighing inflows by around 12 fold, according to analysis carried out by Rplan, the UK-based online fund platform.

Read more

Merlin Properties Socimi’s takeover of Madrid-based rival Metrovacesa is likely to spark further consolidation in the sector, according to Borja Ortega, head of capital markets at JLL in Spain.

Read more

Retail property funds in the UK should expect further markdowns this summer before starting to bounce back, Andy Moylan, head of real estate products at Preqin, told PropertyEU in an interview.

Read more

Despite the raft of UK property funds that have either suspended redemptions or marked down the value of their fund in the past two weeks following the shock UK vote to leave the EU, comparisons to Germany’s open-ended fund crisis in 2009 are premature, according to James Beckham, head of London Capital Markets at Cushman & Wakefield.

Read more

Benson Elliot Capital Management, the UK-based private equity fund manager, has announced the final close of its pan-European fund Benson Elliot Real Estate Partners IV (BEREP IV). The fund will have over €700 mln of available equity, including more than €75 mln of co-investment which has been earmarked for the fund, according to its founder and managing partner Marc Mogull.

Read more

German-listed real estate company Branicks Group has sold a retail property in Bremen city centre to municipal urban developer Brestadt for €37.2 mln.