International student housing data provider Bonard has enhanced its platform to cater to the increasing needs of tenants and investors.

As the real estate market continues to evolve, student housing has emerged as a particularly attractive investment opportunity.

The PBSA sector demonstrated its resilience during the COVID-19 pandemic and subsequent economic challenges, outperforming other real estate asset classes. Despite the crisis, demand for student housing remained strong, leading to rent increases and higher occupancy rates in many countries.

Despite the challenges posed by the crisis, demand for student housing remained robust, leading to rental increases that outpaced inflation in ten out of fifteen countries. Occupancy rates also remained consistently high, typically ranging between 95% and 98%.

With projected declines in interest rates and inflation, PBSA investments are expected to become even more profitable. The sector is characterized by a significant undersupply, even in established study destinations. This shortage, combined with the early-mover advantage, makes student housing an appealing option for investors.

Samuel Vetrak, CEO of Bonard, commented: ‘We are observing more and more investors moving from traditional real estate asset classes to student housing. We are also receiving more data requests than ever. Investors require data on several KPIs to inform investment strategies and transactions; high levels of interest in our data signal that investment and transactions are set to increase.’

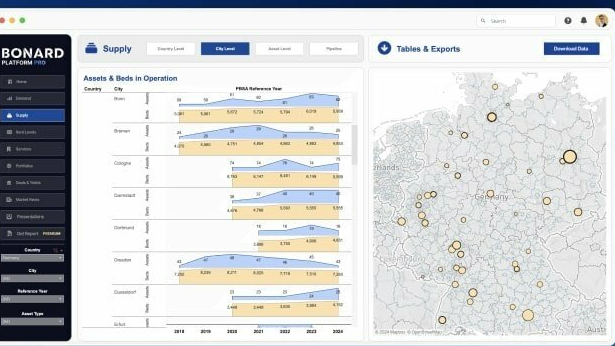

Bonard's flagship offering, the Bonard Platform, delivers detailed, time-series data on critical performance indicators (KPIs) within the global student housing market. This comprehensive platform encompasses over 14,000 assets across 260 markets.

The latest version of the platform includes in-depth asset-level data for granular benchmarking, portfolio information on key student housing investors and operators, and a comprehensive analysis of yield trends in both PBSA and other real estate sectors.

The Bonard Platform offers insights into the following key performance indicators: rent levels; demand; occupancy rates; transactions; yields in PBSA and other real estate sectors; planning, development and construction pipelines; provision rates; asset-level information, including amenities on offer; and portfolios.